My Work

My 5 Ecommerce Predictions for 2022

I can’t believe 2021 is almost over. Time is passing rapidly, and it feels like the world is evolving quickly. Just in 2021, we witnessed:

The easing of a pandemic coupled with tremendous government-driven stimulus.

Significant price increases and supply shortages for seemingly everything.

Global climate shocks including long-not-seen snowfall in Texas and Madrid, record fires in Oregon and Greece, and tremendous flooding in China and India. It feels like we wear masks as much due to air quality as we due to sickness prevention.

This is leading me to think about 2022 and what I feel might emerge around how we conduct commerce. 5 quick predictions:

Resale will thrive. We live in a supply constrained world. Used cars are selling for more than what people paid for them several years ago. Video game consoles are re-selling like luxury items. Until the supply chain clears up, which may not be until 2023, consumers may have no choice but to buy the things they want secondhand and likely for a markup to retail.

Sustainability will gain momentum. The writing seems to be on the wall for businesses that profit at the expense of the environment. What good is “maximizing shareholder value” if there is no planet for shareholders to enjoy? We are beginning to see regulators and consumers demand alignment between business and environment. I expect to see sustainability-forward brands enter the zeitgeist and for all businesses to loudly demonstrate how they offset their environment impact.

Commerce will become entertaining. We live in an entertainment-driven world but commerce is anything but entertaining today. Look at just about any brand’s storefront today and you’ll see a whole lot of 2D photos, text, and buttons. I expect commerce content to converge with what we stare at for hours each day on Instagram, TikTok, Youtube, and Netflix. In fact, these platforms may become the true gateways to commerce themselves.

Virtual goods will be as in demand as physical goods. A lot of physical goods are status symbols. What good is a status symbol though if no one can see it? As remote education and remote work continues to stick around, a significant portion of consumer demand while shift from physical goods to virtual. Consumers will buy the status symbols that can be seen, items like virtual clothing for avatars in games.

The supply chain will begin to be automated. The supply chain shock that we witnessed in 2021 has made the investment case for warehouse robotics and other forms of automation much clearer for businesses. Having toured many warehouses and fulfillment centers, I am personally eager for this to happen. Walking 12 miles per day in a warehouse to pick items off of shelves and put them in boxes is not a type of work that I think we as a society should be putting any people behind. Nor is it the most reliable way to facilitate commerce, which we are witnessing this year.

Community

A few founders are looking to better understand advertising on the connected TV platforms. Should you be up for a conversation on the topic, please let me know.

News

B2B Commerce. PYMNTS shares their Optimizing B2B Payments Report that finds that “67% of B2B buyers report having switched to purchasing from vendors that offer a more consumer-like experience. This share is even higher among millennials, 74% of whom stated they had swapped vendors because the new company offered B2B experiences that are more similar to consumer payments.”

BNPL.

Belk partners with Afterpay to offer BNPL both in-store and online.

Afterpay partners with Rakuten. Will enable merchants like MAC Cosmetics, Crocs, Ulta Beauty, Urban Outfitters, and others to offer cash-back rewards to Afterpay users with the goal of increasing conversion rates and average order values.

Rebecca Minkoff claims that >20% of their customers now use BNPL. “Extending partnerships with BNPL platforms makes sense, as that’s where consumer behavior is heading.”

BNPN. Affirm is rolling out updates that will let customers “buy now, pay now”. Will be coupled with Affirm’s Cash Back program which will let customers automatically recoup a percentage of every eligible purchase in rewards. Those rewards can then be traded for cash or deposited to an Affirm savings account.

BOPIS.

“Buy online, pick up in store” is trending again. Ebay announced a pickup offering in the UK in partnership with locker company InPost. Wish, Amazon, FedEx, and others are scaling out similar offerings.

More on BOPIS initiatives by Kohl’s, Target, and others. “Omni-channel fulfillment, where people buy online and collect from inside a store or curbside, is on course to grow by 28.6% this year.”

Kroger partners with Google Maps to enables customers to utilize the Google Maps app to track their online order status, share their estimated time of arrival, and let the store know when they have arrived to pickup their order.

Brand Rollups.

Business Insider profiles OpenStore, a company rolling up Shopify brands with ambitions of having its own marketplace for its brands in the future. “Shopify's been the most impressive growth story over the last decade in technology. And we think we're actually propelling another decade of growth for Shopify.”

Amazon brand valuations have doubled in the last year, likely as a result of all the capital flowing in to roll up these brands.

Browser Extension. Klarna debuts a browser extension that will allow customers to use the company’s flexible payment options on their desktop computers at all online stores, even those that aren’t Klarna partners.

Crypto.

Eight Sleep launched a $150 crypto rebate for customers. The crypto-focused promotion helped lead to one of Eight Sleep’s most successful sales periods year to date — right up there with Black Friday and Cyber Monday.

PYMNTS’ research shows that about 18% of the U.S. population — approximately 46M people — would be interested in transacting with crypto.

Grubhub partners with Lolli to allow users to earn $5 in bitcoin on their first Grubhub order and $1 in bitcoin on all future orders.

DTC.

Nike will stop selling shoes at DSW, one of their largest wholesale relationships in the US. Nike accounted for 7% of DSW sales in 2020. Nike is rapidly becoming a DTC-only business (only selling through its own stores and ecommerce website).

The founding story of Madhappy, a DTC fashion brand that promotes mental health and raised capital from LVMH.

Unpacking the demise of Casper, the DTC mattress brand.

Earnings Spotlight. Lululemon saw Q3 2021 revenue grow 30% to $1.45B. Was driven by the men’s business growing 44% YoY and women’s growing 25% YoY. They also lowered their 2021 revenue outlook for Mirror, the connected fitness business they bought, to $125-130M down from $250-275M originally. More here.

Fast Fashion. BoF profiles SheIn, the fast-growing fast fashion brand which does $15B in annual revenue and is trying to increase its focus on sustainability. “The company’s software plugs directly into factory floors, enabling it to churn out trends and iterate on popular styles daily. Shein has 600K products on its site at any time and adds about 6K new items every day, with the average item priced at $7.90.”

Food Trucks. Marc Lore, the founder of Jet.com, has left Walmart to focus on a new business called Wonder. Is an on-demand food truck service. The company partners with local restaurants on a food menu and then prepares meals in vans that serve the dual use of mobile kitchens and delivery vans.”

Gaming / Metaverse Commerce.

Dolce & Gabbana expects the whole fashion sector to benefit from the advent of the Metaverse, but see the soft luxury brands (ready-to-wear, leather goods, shoes, etc.) as particularly well positioned as opposed to hard luxury (jewelry and watches).

Ralph Lauren is running a “room” in Roblox called The Ralph Lauren Winter Escape which will feature Ralph Lauren-branded virtual clothing for Roblox avatars.

Dyson launches a VR app to showcase its products digitally including hairdryers and vacuums. “With virtual reality, Dyson claims it is testing a new way to explain the inner workings of its products to customers using the same virtual assets that it created in-house for its research and development process.”

Lancer Skincare launches a VR app to showcase its dermatology products.

Gifting. Video-based gift guides are trending on TikTok.

Home Goods. There is an arms race amongst retailers to meet consumer demand for premium home goods. “People are nesting to the nth degree, taking the same approach to updating their living spaces as they do to picking out an outfit: with an aim to express their style or creativity or simply to feel cozy.”

Influencer-Driven Commerce.

Glossy profiles influencer Danielle Bernstein (2.7M IG followers) and her decision to build her own brand after many years of being paid to promote others.

Machine Gun Kelly launches a male-focused nail polish brand called UN/DN LAQR. “Individualism is dying and self-expression is how we keep that alive.”

Revolve is launching a brand ambassador program targeted towards existing customers that now has 3K members and a waitlist of 10K. “Consumers will now be able to act as influencers for Revolve, receiving rewards and prizes for engaging with their favorite brands and products from the retailer. The program will also offer commissions, including exclusive incentives like early access to new brands, participation in #RevolveAroundtheWorld trips and access to events including the Revolve Festival.”

Insurance. Chewy is now selling Truepanion pet insurance policies on its website.

Logistics.

Gymshark is implementing a warehouse automation system from Exotec to automate picking and packing in their US warehouse.

7-Eleven is piloting autonomous order delivery in California in partnership with Nuro.

Ben Thompson unpacks Amazon’s moves into logistics. Amazon seemingly operates under the framework that all expense line items (shipping, server infrastructure, fulfillment) can be turned in revenue.

Loyalty.

New customer acquisition is more challenging than ever. As a result, brands are investing in loyalty and retention to better retain their existing customers. “Customers enrolled in Adidas’ “Creators Club” volunteer data on who they are and what they buy. It lets Adidas know exactly who its customer is, instead of having to get that profile from outside partners like social media platforms, which have less data to do the job than they used to.”

A look into the strategy behind Madewell’s loyalty program called Insider.

Luxury Resale.

The demographics of luxury retail are changing quickly. “The number of Asia-based customers at Sotheby’s in 2021 is more than twice what it was five years ago. The age demographic change has also been striking. In New York, 50% of Sotheby’s bidders are ages 20-40, while in Hong Kong, that number is more than 60%.”

McKinsey sees luxury resale growing 10-15% annually over the next decade. Is driven by consumer’s desire to buy scarce products and shop in a more sustainable manner. The question is how much brands will be directly involved in the trade.

Macro Summary.

Ben Evans shares his annual tech predictions presentation. Slides 60-80 dive deep into ecommerce trends. TLDR: new gatekeepers (Amazon, Shopify) continue to grow, and those gatekeepers are charging their own rent. New channels also change what is bought (small brands outperform large brands on the internet).

The Fed may curtail stimulus sooner than planned after admitting to a strong economy and inflationary pressure. Is trying to balance inflation versus unemployment, a tradeoff that overarchingly impacts lower income households. Meanwhile Omicron is a real concern and the severity of + vaccine efficacy against it remains unknown.

Omni-channel.

Glossier’s stores are making a comeback. “Retail has always had a unique and important role to play at Glossier. As a digital-first company, our team has had the freedom to experiment with retail in a way that companies that are so closely tied to brick and mortar don’t.”

Wayfair will launch speciality furnitures stores starting with 3 in Massachusetts in 2022.

SpotOn, a point of sale provider, launches SpotOn Retail which will allow independent retailers to sell in-store and online. Also includes national shipping, next-day delivery and same-day delivery through Shippo and DoorDash.

Product Display. Square launches Photo Studio, an app that allows online sellers to take product photos and easily isolate the item and edit the background. “With Square Photo Studio, sellers can give their items the look of a professional photo studio shoot from the comfort of their home, the office, or on the go.”

Product Drops.

PYMNTS conducts a survey which found that 21% of consumers have recently participated in product drops, including 42% of Generation Z and 32% of millennials. Nearly 47% of those who have previously participated in product drops are “very” or “extremely” interested in participating in similar sales events over the next year.

Due to competition to get access to limited inventory, consumers are beginning to turn to paywalled bots to give themselves a fighting chance. “With Christmas fast approaching, the 34-year-old electrical engineer subscribed to a $99-a-month shopping bot called SnailBot that crawls Amazon.com Inc. and Walmart websites. It’s pretty much saved Christmas this year.”

Resale.

Business of Fashion dives into the growing resale trend by interviewing the CEO of Depop and some notable Depop sellers.

Burberry partners with My Wardrobe HQ to make its products available for resale or rental. “My Wardrobe HQ is a unique platform because 50% of rentals convert into a purchase.”

Restaurants.

Small restaurants are falling behind large chains when it comes to benefitting from technology. Independent QSRs generate 38% of their revenue from digital orders now while chain restaurants generate 55%. “While there are third-party providers that can help independents make their offerings more digitally available, small businesses remain at a huge disadvantage in the online marketplace, where the interpersonal relationships that tend to differentiate Main Street businesses are deemphasized.”

QSR Magazine profiles the evolution of how restaurants drive revenue. “At Shake Shack, between March 2020 and November 2021, the brand served north of 3.2M total purchasers on company-owned app and web channels. In Q3, Shake Shack grew this base by 14% QoQ at the same time its dine-in sales lifted double digits and more than 2xed from last year’s levels. At Panera, more than 50 percent of the chains orders currently are processed in some sort of digital fashion that captures data (app, online, kiosk, drive-thru, loyalty at the register).”

WSJ profiles the operational challenges for cloud kitchen operators.

Same-Day Delivery.

Social Commerce.

Wired profiles Bytedance, the company behind TikTok, and how it has other major social platforms like Facebook and YouTube scrambling to keep up. “The growth of shoppable livestreams and deep ecommerce integration, where you can seamlessly click to buy items as they’re mentioned in a video, is an innovation first tested in China, filtered through TikTok, and now adopted by YouTube.”

TikTok rolls out a Seller app to simplify the process of selling products on TikTok (managing inventory and promotions, analyzing orders, etc.).

Flipkart feels threatened by Meesho. The same is true in China where Alibaba and JD.com are nervous about Bytedance, Kauiasho and other quickly scaling social commerce platforms. The first ecommerce race was all about speed (I know what I want, get it to me fast). The second ecommerce race is all about discovery (I don’t know what I want, but if content is entertaining, maybe that’s how I get interested in something).

Spin-offs. Kohl’s is being pressured by an activist investor to spin-off its ecommerce business. Macy’s and Saks Fifth Avenue are getting similar pressure. The general thinking is that the combined company trades at a lower valuation than two separate companies (one for the store business, one for the online business) would trade.

Sustainability. Uniqlo vows to source 50% of its materials from recycled sources by 2030.

Funding and Exits

Brands

Activewear. Maia Active raises $16M from Belle International for its China-focused women’s activewear brand. “In 2021, the company says its revenue will reach 300M yuan, representing a 166% YoY growth.”

Babycare. Evereden raises $32M from GSR Ventures for its line of skincare and haircair products for babies and kids. “Why we’ve grown as quickly as we have is because we have specialized products for each demographic in the family.”

Bird Feeder. Bird Buddy raises $8.5M from General Catalyst for its connected bird feeder product.

Brand Rollups.

SellerX raises $500M in debt and equity from Sofina to acquire brands selling on Amazon. Also acquires KW-Commerce, a private label brand business on Amazon with >$100M annual revenue. Will have 40 brands in the portfolio spanning 25K products.

Merama raises $60M from Advent and Softbank at a $1.2B valuation to acquire Latam-based brands. “Has 20 brands across Mexico, Brazil, Chile, Colombia and Peru, is poised to sell over $250M of product merchandise this year, and will be “significantly cash flow positive.”

Opontio raises $42M from STV to acquire brands in Eastern Europe, the Middle East, and Africa. Has acquired 15 brands to date.

Quinio raises $20M from Cometa to acquire Latam-focused brands operating on MercadoLibre, Shopify or Amazon. Has already acquired 10 brands.

Consumables. Grove Collaborative files to go public via SPAC at a target $1.5B valuation.

Fitness. Clmbr raises capital for a host of influencers including Odell Beckham Jr., Pitbull, Novak Djokovic, Ryan Seacrest and others for its connected vertical climbing fitness device.

Food and Beverage. The Every Company raises $175M from McWin and Rage Capital for its animal-free protein product that is sold to food brands to make animal-free products.

Hair Care. P&G acquires Ouai, the haircare brand built by celebrity hairstylist Jen Atkin.

Skincare.

L’Oreal acquires Youth to the People, a superfood-based skincare brand expected to do $50M revenue in 2021.

Orveda raises capital from Coty for its vegan, genderless, microbiome based skincare. “This brand really fills a void that we had on the high end procedure side of the market. It’s a part of the market that is booming right now.”

Facetheory raises $13M from Active Partners for its clean skincare brand that has a focus on local, sustainable manufacturing. “Has over 350K active customers of which over 40% are based outside the UK. Has also seen impressive revenue growth, accelerating from £2M to £15M over the past 3 years.”

Marketplaces

B2B Commerce.

TradeDepot raises $110M from IFC for its B2B marketplace in Africa that connects brands with retailers to simplify inventory purchasing. “Has 100K+ merchants on the platform and GMV has grown 5x in the last year.”

Clubbi raises $4.5M from Valor Capital Group for its B2B marketplace connecting food brands with food retailers in Brazil. “Launched in Oct 2020 with 24-hour delivery, no minimum order quantity and flexible payment terms. It is currently working with 1K grocery stores in Rio de Janeiro, up from 3 at launch, with plans to grow to over 3K by mid 2022.”

Fashion. Saks Fifth Avenue is moving forward with spinning out its ecommerce business into a separate publicly traded company. Insight Partners is investing $500M at a $2B valuation for a minority stake ahead of this.

Grocery. Boxed completed its SPAC-backed IPO today.

Restaurants. Snackpass, a pickup only ordering app for restaurants, acquires Sleek, a service that allows consumers to skip long lines.

Tires. Discount Tire acquires Tire Rack, the industry’s large online tire seller.

Used Cars.

Carzam raises $148M from an undisclosed fund for its used car marketplace in the UK. Promises to deliver cars nationwide in 24 hours.

Carma raises $20M from Tiger Global for its Australia-based used car marketplace where Carma buys and re-sells used cars on its own balance sheet. “The company currently has a fleet of 300 vehicles in stock, which it sources from private sellers, other dealers and auctions, but will shortly have over 500.”

Software

B2B Commerce. Marketplacer raises $38M from Acorn Capital, Ellerston Capital and others for its SaaS platform that enables customers to build successful and scalable online marketplaces. Has enabled 100 marketplaces to date which serve 13K business customers.

Cross Border Enablement. Global-e acquires Flow Commerce, a cross-border ecommerce software provider for $500M.

Headless Commerce. Uniform raises $28M from Insight Partners for its headless website platform. Features no-code tools for marketers and merchandisers to create digital experiences and built-in personalization to enable unique digital experiences

Live Shopping. Livebuy raises $5.1M from RTP Global for its embeddable live shopping product. Has customers including Lidl and MediaMarktSaturn.

Restaurants. GrubTech raises $13M from Addition for its operating system for restaurants and cloud kitchens which is used by clients across 15 countries in the Middle East, Africa, Asia and Europe.

Website Builder. Universe raises $30M from Addition for its mobile app that allows website / ecommerce site creation from a mobile phone. Claims to have 500K users.

Fintech

B2C BNPL. Sympl raises $6M from Beco Capital for its Egypt-focused BNPL product. “Is now accepted at more than 240 retail and online stores in Egypt.”

B2B BNPL. Resolve raises $25M from Insight Partners for its B2B-focused BNPL product. Is a spin-out company from Affirm.

Inventory Financing. Tradeshift raises $200M from Koch Industries and others for its B2B inventory financing platform. “Says the cumulative value of transactions processed across its network has passed the $1T mark, having 2xed in 2 years.”

Neobanks.

Logistics

Autonomous Delivery. Serve Robotics raises $13M from DX Ventures, Uber, 7-Eleven and others to expand its autonomous sidewalk robot-based delivery service. “Its robots have completed tens of thousands of contactless deliveries from over 100 merchants in LA and San Francisco.”

Cloud Kitchens. Reef, a large scale cloud kitchens operator, acquires a competitor, 2ndKitchen.

Reusable Packaging. Dispatch Goods raises $3.7M from Congruent Ventures for its circular plastic packaging service. “Now collects and processes between 10-15K food packages a week. It is already working with over 50 customers, like DoorDash, Imperfect Foods and 50 restaurants in the Bay Area.”

Product of the Week

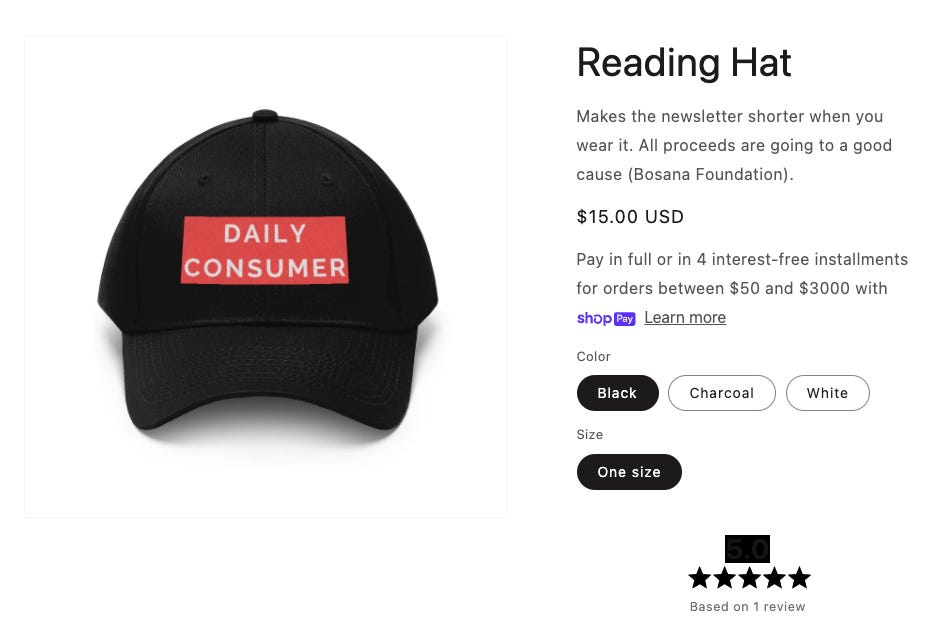

I have the perfect holiday gift suggestion this year. Get your loved one a limited edition Daily Consumer hat. All proceeds will go to Bosana Foundation, my favorite non-profit. Buy it here.