Daily Consumer #29 - Inflation Is Shifting Demand To Staples

Luxury demand however remains very strong.

Unpacking the Industry

💁♀️ Consumer demand is always changing. Categories on the move:

🔼 Baby formula is facing a huge shortage. 40% of stores in the US are out of stock! There are multiple reasons. Abbot, the largest US producer of baby formula, faces a recall driven by the FDA due to instances of a dangerous bacteria being found in their product. Meanwhile retailers didn’t plan their inventory levels well due to volatile consumer behavior in the pandemic (think hoarding). Lastly, US regulation of formula is very strict so European brands aren’t allowed to be imported. Hopefully this gets resolved soon.

🔼 Makeup is making a big comeback post-pandemic and in particular the trend of bold expressionism. Sales in the category are up 22% YoY. “I think we’re in a makeup renaissance right now.”

🔼 Beardcare is a fairly new product category that is increasingly getting its own dedicated shelf space in retail. The market has grown 7x since 2016. “During the worst of the pandemic, when almost everyone was stuck at home, many men stopped shaving.” Gillette has focused on this as well by launching their King C. Gillette line of products for men with beards in 2020 which now does >$200M revenue annually.

🔼 Socks were the top shopping category in the pandemic, replacing t-shirts. “The trend dovetails with people staying at home for longer periods, as nearly 70% of American adults wear socks around the house.”

🔼 Designer apparel and footwear spend, driven by the world re-opening, caused Nordstrom to see revenue grow 23% YoY. Execs also cited strong demand from affluent customers.

🔼 🤗 Haircare is another category benefitting from the world re-opening. Wella Company acquires Briogeo, a clean haircare brand. L Catterton acquires Bellami Hair, a D2C hair extension brand. Helen of Troy acquires Curlsmith, a product line for textured hair, for $150M.

🔼 🤗 Fragrance is another booming category post-pandemic. Luxury fragrance brand Byredo was acquired by perfume group Puig for $1B this week. “Branding for these scents centers on ‘stories’ about travel and feelings, or more intense or rare ingredients, in contrast to blockbuster fragrances with more generic notes.” Fragrance spend grew 28% YoY across the category.

🔼 Activewear continues to grow as a category as consumer interest in exercise and comfort grows. Lululemon saw revenue grow 32% YoY to $1.6B in Q1 2022. Walmart is the latest to enter the market with the launch of Love & Sport, a private label brand created in partnership with fashion designer Michelle Smith and fitness superstar Stacey Griffith. Meanwhile Gymshark saw revenue grow 54% YoY to $506M.

🔼 Faux fur sales grew 72% from 2020 to 2021 while sales of genuine fur fell 44%.

🔼 Sportswear is another growing category coming out of the pandemic, especially tennis and golf. Lululemon announces its first golf clothing lines for men. Fabletics launches tennis wear. 💵 Johnnie-O meanwhile raises $108M from Ares and Wasatch Global Investors for its West Coast-inspired prep fashion brand founded by a former college golf player. “The ecommerce channel, in particular, has been growing rapidly, leading to sales and EBITDA growth of more than 80% in 2021.”

🔼 Streetwear is another category that continues to grow in interest as it continues to be young consumers preferred type of luxury spend. The latest development is Marquee Brands acquiring Anti Social Social Club, a popular fashion label.

🔼 💵 Upside Foods raises $400M from Temasek and Abu Dhabi Growth Fund for its lab-grown meat products. Its products will be available in the US later this year.

🔽 Furniture spending is falling however as consumers shift their spending out-of-the-home. Wayfair saw Q1 revenue decline 14% YoY to $2.99B.

🔽 🔔 Instacart files to go public but is also seeing rapidly slowing growth for its grocery delivery service with revenue up just 15% in 2021 versus 2020.

🌎 The macro environment plays a big role in demand.

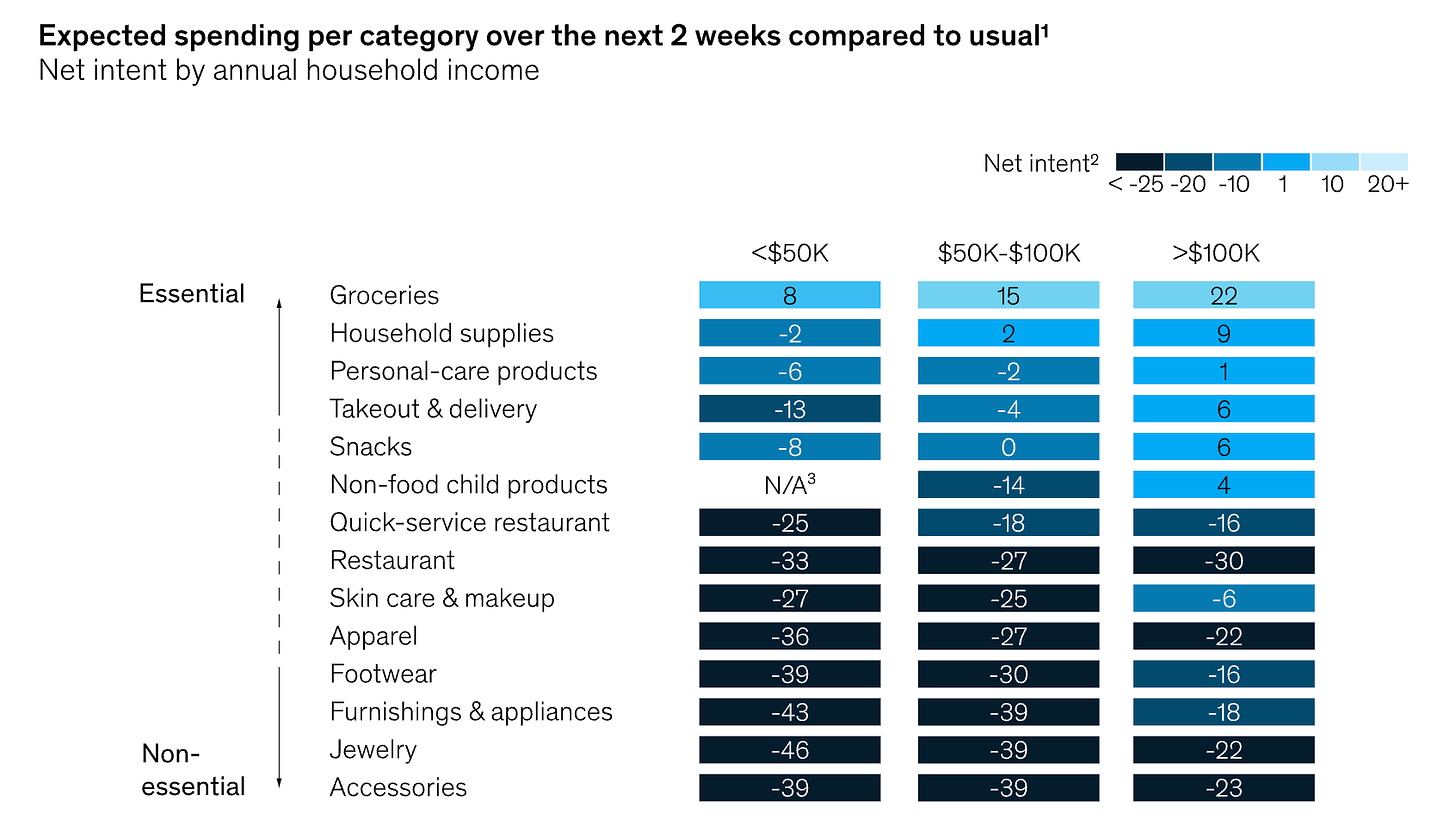

Inflation is driving down spending intent for non-affluent consumers across every category especially discretionary areas per a McKinsey survey. Private label brands are also gaining market share.

More evidence that inflation is causing consumers to shift their spending to essentials. 61% of consumers purchased almost exclusively daily essential items like gas, health products and food in March according to The Connected Economy Monthly Report. Per a Digital Economy Payments survey, payment declines due to insufficient funds rose 43% between March and April 2022.

Inflation is causing retailers to post poor performance in CYQ1 including Kohl’s (revenue declined 5% YoY), Best Buy (revenue declined 8.5% YoY), Gap (revenue declined 13% YoY), Big Lots (revenue declined 15% YoY), and Target (operating margin declined by ~5%). Retailers oriented around discretionary spend, like Best Buy, are in for some painful quarters ahead.

Inflation is also causing brands to raise prices. “Unilever's full-year costs are going to quadruple versus a year ago. That's why the pricing needs to be so high, and that's why the price is going to go much higher. This is not the peak.”

The Ukraine war and backlash from multi-national brands is causing Russian consumers to start buying from Russian clothing brands instead.

China’s covid lockdowns continue which is impacting Farfetch’s business. However, the luxury fashion marketplace still grew CYQ1 GMV 2% YoY to $931M and revenue 6% YoY to $515M.

💎 Luxury continues to thrive.

Affluent customers are not experiencing inflation like the rest of consumers. “We are not even close to experiencing a luxury down-turn, we see many people that are affluent and even the middle classes want to indulge. The overall demand for luxury products and premiumized products is very high – the market is premiumizing overall.” - L'Oreal CEO Nicolas Hieronimus

Oura creates a collaboration with Gucci which puts its product at the intersection of connected health, jewelry, and luxury.

Balenciaga announces a partnership with Adidas. “Will see the fashion house subvert and reinterpret the signature DNA of the Three Stripes.”

YSL doubled revenue over the past 5 years by making the brand sporty and youthful. Will do over $3.2B in revenue in 2022. “They’ve really harnessed that Parisian chic, that luxury cool girl and wrapped it up in a way that appeals broadly.”

Canada Goose is seeing strong demand for its luxury parkas and jackets. CYQ1 revenue grew 6% YoY to $177M.

Tag Hauer, a watches brand owned by LVMH, starts accepting cryptocurrency on its ecommerce store powered by Bitpay. A move to appeal to the crypto wealthy who may start looking to put their money elsewhere as crypto trades down?

Rebag launches Rebag Auction, a feature that allows users to bid on high-end items including bags and watches.

👷 Ecommerce is still broken…

Trust and safety is still an issue in ecommerce. Nike sues StockX for selling fake sneakers. Amazon works to shut down fake review brokers.

Fit is an ever-present issue for fashion ecommerce companies. Levi’s is piloting two new features to help consumers called “See It In My Size”, which shows the same product on models of different sizes, and “What’s My Size?”, an algorithm that asks questions to suggest a size to the shopper.

Returns are very expensive for merchants to deal with, especially in fashion where >50% of orders are returned. Zara has started charging customers in the UK $2.44 for every return done via mail. Loop, a returns management software platform, partners with Happy Returns to enable its merchants to process returns via Happy Returns’ 5K+ return bars. Doordash and Narvar are launching services to pick up ecommerce returns from consumers.

Out of stock is still prevalent in online shopping. 55% of shoppers find a specific apparel item they want is often or always out of stock online when they shop.

💵 Storyblok raises $47M from Mubadala Capital and HV Capital for its headless CMS platform for both technical and non-technical users like marketers to manage content that appears across websites, apps and other digital interface. Has 74K companies including Netflix, Adidas, T-Mobile, Happy Socks and Deliveroo as customers.

💵 Firework raises $150M from Softbank at a $750M valuation for its liveshopping software used by retailers like Albertson’s, The Fresh Market, and others.

💵 Zowie raises $14M from Tiger Global for its automation-driven customer support software serving ecommerce merchants. “Cutting-edge technology automates 70% of inquiries that ecommerce brands typically.”

💵 Bold Metrics raises $8M from Bessemer for its AI-first SaaS product focused on fit. Helps fashion companies like Canada Goose, Tailored Brands, SuitShop, and others recommends products to shoppers based on size and uses customer body type information to inform the fashion brands on how they should design their products.

💵 ZMO raises $8M from GL Ventures to generate virtual fashion models via AI.

📈 … But ecommerce continues to grow.

Ecommerce purchasing is still up significantly from pre-Covid especially in grocery and personal care.

McDonald’s digital sales in the US topped $2B in the Q1 2022 —more, for instance, than the total system sales generated by In-N-Out last year. That represents about 20% of total sales during the period.

According to the Department of Commerce, total US ecommerce sales over the past twelve months reached $975B, up from $518B three years ago.

📲 The large internet businesses (Facebook, Google, Snap, etc.) are trying to make it easier for merchants to acquire customers…

Shopify launches Audiences, a tool that uses machine learning to help Shopify merchants find motivated shoppers. Takes aggregated conversion data from all participating merchants, zeroing in on who’s buying particular items, so it can create custom audiences for other merchants to market specific products. Merchants can then export these audiences to Facebook, TikTok, etc. to market to them. More here.

Snap launches Dress Up, an AR capability that lets users try on fashion products virtually. Also integrates eBay listings that can be shared via Snaps.

TikTok partners with Woocommerce, a popular ecommerce platform, to connect Woo’s 3.7M stores to TikTok’s >1B users. Will also Woo users to create adds in their dashboard and to track the performance of traffic coming from TikTok. 40% of Gen Z TikTok users spend >3 hours on it per day. TikTok will see more user time spend than YouTube in the US this year. When will commerce follow?

Google is selling its search technology, called Google Retail Search, directly to brands to use for search on their ecommerce stores. Macy’s is an early customer and has seen 2% increase in conversion and 1.3% increase in revenue per visit.

Chipotle is testing a marketing campaign on BeReal, a new social app emerging in the US and Europe that is popular amongst Gen Z and built to only allow candid, authentic photo sharing.

Disney unveils more plans to create an ad-supported version of Disney+. “Will reportedly run ads for four minutes on movies or shows that last an hour or less.”

🤗 Amazon acquires GlowRoad, an India-focused marketplace that sells products to customers at wholesale prices and helps them resell on Facebook and WhatsApp. Has over 6M resellers who earn on an average of $460 per month. Is a competitor to Meesho.

🤗 Pinterest acquires The Yes, a personalized fashion shopping app. The Yes will shut down its app and site and will focus solely on building out commerce on Pinterest.

🤝 … But acquiring customers is still expensive and inefficient.

Conversion attribution has broken down. “With what Google’s saying, what Facebook is saying, etc., it’s like one plus one equal 15, because we (Parachute) see that there aren’t that many sales coming in.”

Snap issues a revenue warning as advertising demand is trending far below expected. Further signs that direct response marketing is breaking. “The timing of ATT could not be worse: at the very moment when performance-based direct response advertisers should be naturally filling the void left by brand advertisers, thanks to their ability to track return-on-advertising-spend to the penny, that ability was taken away.”

🏬 … Which gives retail its place.

Uniqlo, a leading fast fashion brand, is seeking to add 200 stores in North America over the next 5 years and currently opens 400-500 new stores globally per year.

Ikea, the leading affordable furniture brand, is investing >$3B to globally renovate stores, add new stores, and strengthen its delivery capabilities.

Amazon Go is starting to launch autonomous convenience stores in suburban markets. Has rolled out 28 Go stores to date. Circle K launches its 2nd autonomous convenience store in partnership with Standard AI. Amazon is also opening fashion stores called Amazon Style.

Allbirds is growing its wholesale relationships. Will sell its shoes in retailers like Nordstrom, Zalando, and Public Lands going forward.

Farfetch is selling the clienteling software it uses in its Browns department stores to other brands including Chnael. “30-35% of in-store sales are done from stock which is not in the store. Through the in-store app, the sales associate is able to tell the story of this product and the consumers want to buy it even if they haven’t tried it on.”

Remote work is causing retailers to open stores in increasingly suburban areas.

💵 Mashgin raises $62.5M from NEA at a $1.5B valuation for its touchless self-checkout systems. Allows customers to pay in as little as 10 seconds using AI instead of barcodes. Has completed more than 35M transactions in more than 800 locations.

📣 … And gives creators and influencers an important role.

A great story behind Nike’s chase to sponsor LeBron James coming out of high school.

Per a survey from Oracle, Gen Z consumers are the most likely to discover products and brands via influencers (32%), compared to 28% of overall respondents and only 13% of surveyed boomers. In addition, 84% Gen Z respondents have purchased products in direct response to social media content, compared to only 46% of surveyed boomers. YouTube is the most popular channel overall, with 21% of respondents following influencers on YouTube. Gen Z respondents, however, favor TikTok (25%).

Ruggable observed a 32% conversion uplift when creative assets come from influencers or creators rather than being developed in-house. “Non-celebrity influencer content is trusted because of the intimate relationships these kinds of influencers have with their audiences.”

My Index Ventures colleague Rex unpacks that state of influencer marketing here.

💵 Mavrck raises $135M from Summit Partners for its influencer marketing platform and acquires Later, a link-in-bio solution. Works with 5K marketers across 500 consumer brands to connect with some 3M creators, paying out over $200M to date.

💵 Lemon Perfect raises $31M from Beyonce, Beechwood Capital, and others for its hydrating lemon water brand. 4xed its revenue to $21M in 2021 and estimates $60M in retail sales in 2022. “Beyonce had posted a photo with our product in her limo, and all of a sudden my phone blew up.”

🫶 … And is also motivating online merchants to drive traffic to one another.

Ulta launches an ad network called UB Media that lets advertisers market to its Ultamate Rewards members.

Albertson’s launched a retail media network and is starting to show it works. “Shows a return for CPGs of up to $14 for every dollar spent.” A good interview with their SVP of Retail Media.

Chewy.com is launching a sponsored ad capability on its marketplace in 2023.

Victoria’s Secret launches a marketplace called VS&Co-Lab that allows other female-oriented brands to sell their products on VictoriasSecret.com. Features 19 brands today of which 75% are founded, owned or led by women.

🏛️ … And is benefitting large-scale marketplaces.

Victoria’s Secret starts selling beauty products on Amazon.

💵 Bucketplace raises $182M from SoftBank Ventures, Vertex Growth, and others at a $1.4B valuation for its Houzz-like marketplace in Asia that collects home decorating and interior design content and drives commerce to service providers and furniture brands. Has 10M users visiting the platform each month across the app and website.

☎️ Retaining customers is becoming more important by the day…

Per McKinsey, 36% of consumers tried a new product brand and 25% incorporated a new private-label brand during the pandemic.

SMS marketing is becoming vital for brands. “It’s hard to beat the open rate, which borders on 100% thanks to the fact that Americans check their phones about 96 times a day (an actual number derived from surveys and not a typo).”

💵 Zeals raises $27M from JIC Ventures for its Asia-focused software allowing merchants to communicate with their customers via its chatbot software. Has 400 customers including, including Toyota dealerships, Shiseido and NTT Docomo.

🤑 … Especially the high spenders.

Luxury brands are hosting lavish experiences to cater to high spenders. “Trips and seats at fashion shows are the most exciting ways to draw in top shoppers. Saks Fifth Avenue has taken some of its VICs to the Oscars and Wimbledon. Gucci has hosted movie screenings in the Savoy’s Royal Suite in London.”

Chanel is opening private stores for their top clients. “We are not, and will not, sell fashion or watches online.”

🔁 Subscriptions and memberships continue to grow in popularity.

62% of US households subscribe to at least one retail membership. 54% subscribe to Amazon Prime, the leading program, which is 6.6x bigger than runner-up Walmart+ (8.1% of households). Amazon has 166M US consumers in Prime now.

Walmart gives Walmart+ subscribers 10 cents off per gallon of gas at participating fuel stations.

Lululemon is launching two tiers of membership, a paid and a free tier. The free tier will give customers early access to Lululemon product drops and exclusive items along with invitations to in-person community events. The paid tier will cost $39 per month and will include the same benefits as the free one with extras such as access to unique fitness content.

Panera launches Unlimited Sip Club, a subscription program that offers consumers unlimited self-serve beverages for $10.99 per month.

The average US subscriber has dropped 1 of their 5 retail subscriptions since October 2021 mainly to save on expenses.

💳 Customers today can choose between many types of payment methods to make transactions with.

Stripe partners with Affirm to offer BNPL to US Stripe users. Shopify extends its partnership with Affirm. Urban Outfitters is partnering with Klarna. Fiserv partners with Affirm. Adyen partners with Afterpay. Rite Aid partners with Afterpay.

Apple is rolling out phone-to-phone tap payments in its own stores. Coming to more stores near you?

Amazon is rolling out palm scan payments in Whole Foods stores.

Google is rolling out virtual cards for the Chrome browser which converts credit-card numbers into a different, distinct number, so the actual info isn’t shared with the merchant, which should keep it safe and sound in the case of a leak.

💵 Concerto raises $21M from Matrix Partners to develop credit card programs for brands using advanced data analytics to predict risk. Is focused on baseball teams to start and is working with the Texas Rangers, Los Angeles Angels, Baltimore Orioles and Cincinnati Reds to roll out Mastercard-issued cards and programs with access to exclusive experiences and memorabilia.

🛒 Wholesale is still so complicated.

65% of B2B commerce companies now offer ecommerce sales capabilities that let customers pay online. Wholesale is getting digitized.

💵 Faire raises $416M from YC, Sequoia, and others for its US and Europe-based marketplace connecting brands with independent retailers. Connects 450K retailers globally to more than 70K brands from over 100 countries.

💵 Inventa raises $55M from Greylock for its Latam-based B2B marketplace connecting brands with independent retailers. Has 40K retailers and 800 brands on the platform.

🤗 BigCommerce acquires Bundle B2B to offer more B2B commerce capabilities to BigCommerce merchants.

🚢 The logistics of moving products from factories to warehouses to consumers are still so expensive …

🤗 Shopify acquires Deliverr for $2.1B. Will be combined with with Shopify Fulfillment Network - Shopify’s fulfillment service that merchants can use to store inventory and fulfill orders — to strengthen SFN’s inventory management capabilities on behalf of enrolled Shopify merchants. Logistics is a big area of pain for merchants and Shopify wants to provide the painkillers.

Amazon launches Buy With Prime which seeks to power checkout and delivery for other ecommerce companies. Merchants can now enable true Amazon-grade checkout and delivery speed on their own stores. Shots fired at Shopify which responded with Shop Promise - a capability for merchants to offer reliable 2-day deliveries and hassle-free returns. Meanwhile, American Eagle wants to become a logistics provider to other brands after acquired two companies and launching the Quiet Platform which serves 50 other merchants today.

Amazon also launches a $1B investment fund to support logistics and fulfillment technology innovation. Their initial focus is on wearable technology that enhances safety in fulfillment buildings and robotics designed to complement and coexist with people’s lives.

Amazon is rolling out Amazon Hub Delivery Partner program where they partner with mom-and-pop shops, like florists and restaurants, in rural America to have them start delivering packages. USPS doesn’t perform well in middle America.

Drones are showing growing potential to automate last-mile delivery. Walmart is expanding its unmanned aerial delivery service with partner DroneUp to 6 states, with plans to complete 1M drone deliveries by the end of the year.

Merchants and logistics companies are becoming more interested in robotics as warehouse labor gets more challenging. Walmart is deepening its relationship with Symbiotic and will implement their robotics solutions in all 42 of its regional distribution centers. DHL is piloting robotics for sortation in its warehouses and is seeing promising results.

💵 Instabox raises $190M from Verdane for its automated parcel locker service that works with select ecommerce merchants. Has customers including H&M and Lyko.

💵 Stord raises $120M from Franklin Templeton at a $1.3B valuation for its marketplace that connects 1K+ fulfillment centers with major brands like Thrasio, and Native which need to store products and fulfill ecommerce orders.

💵 Nomagic raises $22M from Khosla Ventures and Almaz Capital for its robotic arms that can automate picking and packing of goods in warehouses.

💵 Eurora Solutions raises $40M from Connected Capital for its machine learning-driven cross-border customs compliance platform used by >200 customers. “The number of different declarations, codes, reports, records and tax calculations required in the international shipping business is ever increasing.”

🚚 ... But same-day delivery is expanding the ecommerce market.

Amazon is allowing Flex drivers, which are their contractors that deliver packages last-mile, to now pick up and deliver packages from other local retailers as well.

Doordash, the leading restaurant delivery service in the US, saw CYQ1 revenue grow 35% YoY to $1.46B. Total number of orders it delivered during the quarter rose 23% YoY to 404M and saw the most new customers added to its service since the Q1 2021. Also recently signed a partnership with SpartanNash to power on-demand grocery delivery for the grocery company’s 2.2K stores. DoorDash also earned 59% of US consumers’ meal delivery sales in April 2022, while Uber Eats came in second place with 24%.

Per GrubHub, 41% of independent restaurants are now operating virtual food brands. Food delivery apps are now implementing rules for virtual brands to be listed. “For Uber Eats, out of about 800K global restaurants registered on the app, more than 20K are virtual.”

Publix launches 15-minute delivery in Florida from Instacart’s nano-warehouses.

💵 Flink raises a rumored $75M from Carrefour at a $5B valuation for its 15-minute delivery service and acquires competitor Cajoo which has 400K customers in France. “Flink is currently operating at an ARR of $500M and is growing revenues at double-digit percentages week-on-week.”

💵 Astro raises $60M from Accel, Citius and Tiger Global for a similar business in Indonesia.

☮️ Aligning commerce with social good (sustainability, social justice, equality) is becoming necessary.

Per a survey from Attest, the issues consumers care most about are poverty, racism, and sustainability in that order.

Per a survey from Google Cloud, 82% of consumers say they want to buy from brands with values that align with their own.

Unfortunately, it feels like every month there is a new social justice issue. In light of the tragic school schooling in Texas, Goop, ThirdLove, Madewell, Yeezy, and other brands made statements calling for an end to gun violence. On the rumors of Roe v. Wade being overturned, 62 beauty and wellness brands including Fenty Beauty and Glossier have signed on as partners of Don’t Ban Equality. Uniqlo launches Buy With Purpose, a new feature on its app and website that rewards customers' purchases of certain items with a donation. The donation is made from Uniqlo on the customer's behalf to one of the retailer’s three non-profit partner organizations.

Sustainability continues to becoming a more pressing theme for brands. Dick’s Sporting Goods partners with Out&Back, an online platform that buys and sells new and used outdoor and adventure gear, on a resale program. REI’s Re/Supply buy-back program grew 86% YoY in 2021. The North Face launches a resale program in partnership with Archive. There are now 130 brands and retailers that have launched their own resale programs. 74% of retail execs are offering or open to offering secondhand products to their customers per ThredUp.

Meanwhile, Business of Fashion ranks the more sustainable brands. Puma tops the list.

LVMH Beauty partners with Origin Materials to create sustainable beauty product packaging.

💵 VitroLabs raises $46M from Kering for its lab-grown leather. VitroLabs uses stem cells to grow leather that’s indistinguishable from the real thing without needing to raise and slaughter animals.

💵 Planet FWD raises $10M from Acre Venture Partners and Congruent Ventures for its software allowing consumer products companies to assess and reduce their carbon emissions. Customers include Kashi, PANGAIA, and Just Salad.

🔮 Is crypto/metaverse a solution trying to find a problem in commerce? Or the future of commerce?

Gucci will start accepting 10 cryptocurrencies in retail stores in Miami, Los Angeles, New York, Atlanta and Las Vegas.

Per an Accenture survey, 55% of consumers agree that more of their lives and livelihoods are moving into digital spaces. 64% had already purchased a virtual good or taken part in a virtual experience or service in the past year.

Meta (fka Facebook) is testing new tools to allow select content creators to sell virtual products on its Horizon Worlds metaverse platform. Meanwhile, Gap launches “Club Roblox Boutique” in Roblox, which is a metaverse version of a brick-and-mortar Gap Teen store. The virtual boutique enables consumers to take part in digital activities such as joining Gap Teen’s fashion show mini-game, “Style Stage.” Gucci also launches Gucci Town in Roblox, a space featuring a central garden that links together various areas, including a space for mini-games, a cafe, and a virtual store where players can purchase virtual Gucci gear for their avatar. And Puma launches “Puma and the Land of Games” in Roblox.

Many large brands including Adidas, Balenciaga, Dior, Vans, and others are turning to agencies like BeyondCreative, MA + Group, The Gang, Superficial, and Emperia to set up their metaverse presences.

Nike launches its first line of virtual NFT sneakers post acquisition of RTFKT.

💵 Arianee raises $22M from Tiger Global for its web3 platform for brands to create and distribute NFTs, which are typically linked to physical goods. Customers include Breitling, ba&sh, Vacheron Constantin, and others.

Fantastic read. Very digestible. Ty