Daily Consumer #31 - Ecommerce Is Slowing But Consumer Spending Is Still Strong (For Now)

DTC brands are expanding offline. Meanwhile, luxury brands are seeing tremendous momentum.

Unpacking the Industry

💁♀️ Consumer demand is always changing. Categories on the move:

🔼 Apparel and accessories orders are up 13% YoY per Klaviyo.

🔼 Food and beverage orders are up 12% YoY per Klaviyo.

🔼 🔊 Athletic footwear sales are strong. Decker’s FYQ1 2023 revenue grew 22% to $614M. Growth was driven by the HOKA brand, which saw revenue grow 55% YoY to $330M.

🔼 🔊 Cosmetics sales are also strong. L’Oreal H1 2022 revenue grew 21% YoY to €18.3B. “Consumers confirm their desire to socialize and indulge themselves with innovative and superior beauty products.”

🔼 Sunscreen continues to grow as a category as more consumers invest in their skincare. Cosmetics and haircare brands are starting to release SPF-infused products.

🔽 Electronics orders are down 5% YoY per Klaviyo.

🔽 Hershey’s says it won't have enough production capacity to meet Halloween demand this year. Get your bowls filled early.

💵 Kizik raises $20M from The Newcastle Network for its hands-free shoes. “Our online sales growth is phenomenal.”

💵 Bryte raises $20M from Tempur Sealy for its smart mattress that measures, learns, tests, and applies what each sleeper needs to optimize their restorative sleep."

💵 Gym+Coffee raises €17M from Castlegate investments for its athleisure brand.

🌎 The macro environment plays a big role in demand. Spending is still strong but cracks are forming.

63% of consumers have concerns about affording basic necessities per a PYMNTS survey of 3,783 US consumers.

66% of 1,000 Signifyd survey respondents cut back on spending in 2022 in the face of persistent inflation.

🔊 Visa Q3 2022 revenue grew 20% YoY to $7.3B and beat expectations. “We’re seeing no evidence of a pullback in consumer spending.”

🔊 Mastercard Q2 2022 revenue grew 21% YoY to $5.5B. “Increasing inflationary pressures have yet to significantly impact overall consumer spending but we will continue to monitor this closely.”

🔊 Walmart warns that higher prices for food and fuel are causing consumers to pull back. Announces it will significantly cut prices to reduce merchandise levels at its flagship chain and Sam’s Club. Now expects its operating income to decline 10-12% for the fiscal year.

🔊 Best Buy shares a guidance update and now expects Q2 comparable sales to decline ~13% YoY. “Consumers are pulling back at a faster, deeper pace than we had initially assumed as they spent money on experiences or became more budget-conscious as food and gas prices rose. As high inflation has continued and consumer sentiment has deteriorated, customer demand within the consumer electronics industry has softened even further, leading to Q2 financial results below the expectations we shared in May,.”

🔊 Procter & Gamble FYQ4 2022 revenue grew 3% YoY to $19.5B. “Higher pricing during its fiscal fourth quarter offset a slip in sales volume.”

Amazon is raising the price of its Prime subscription across Europe in September by up to 43% due to increased inflation and operating costs.

💎 Luxury continues to thrive.

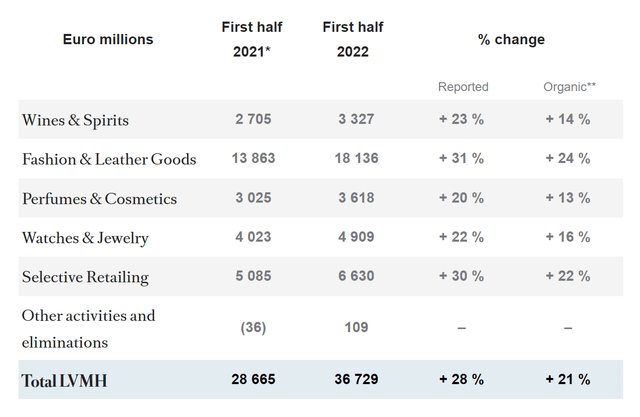

🔊 LVMH H1 2022 revenue grew 21% YoY to €36.7B. All business segments grew by double-digit rates. “The top end of the portfolio has done better than the entry price, but it’s on purpose because we intend to rebalance the two.”

🔊 Hermès Q2 2022 revenue grew 20% to $2.8B and beat expectations. While known for leather goods like Birkin bags, the company saw their watch division perform best with 49% YoY growth.

🔊 Moncler H1 2022 revenue grew 48% YoY to $930M and beat expectations. “Even though the first half of the year was marked by strong macroeconomic and geopolitical instability, we have exceeded our expectations.”

🔊 Prada H1 2022 revenue grew 22% YoY to $1.9B. “We have more than compensated for the impact of various lockdowns in mainland China and for sanctions on Russia.”

👷 Ecommerce is still broken…

Ecommerce returns in 2021 totaled $761B in lost sales. “This is more than the annual budget for the U.S. Department of Defense. I have never seen the pressure in terms of excess inventory as I am seeing right now.”

Ben Evans shares some provocative views on the ecommerce trend. “Perhaps the real long-term trend is that the historic separation between rent on one side and advertising and marketing on the other is now disappearing. ‘How do you reach your customer?’ becomes one question and one budget.”

🐢 … And ecommerce is showing some signs of slowing.

🔊 Amazon ecommerce sales fell 4% YoY to $50.9B.

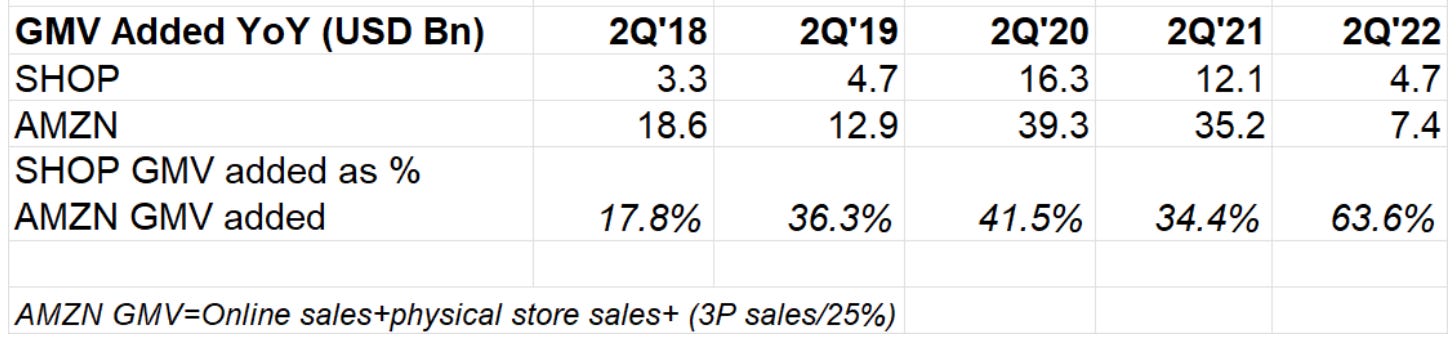

🔊 Shopify Q2 2022 GMV grew 11% YoY to $46.9B and revenue grew 16% YoY to $1.3B. “2022 will be different, more of a transition year in which e-commerce is largely reset to the pre-COVID trend line and is now pressured by persistent high inflation.”

🔊 Amazon added more GMV in Q2 2022 than Shopify ($7.4B versus $4.7B) but both are slowing dramatically post-pandemic.

Shake Shack now drives 43% of revenue through ecommerce, which includes sales from its app, website and delivery. The mobile app launched not long ago in 2017.

🔊 Decker’s D2C revenue grew 15% YoY to $185M, which was 30% of total sales.

📲 The large internet businesses (Facebook, Google, Snap, etc.) are trying to make it easier for merchants to acquire customers…

🔊 Amazon advertising sales grew 17% YoY to $8.8B. “I think our advantage is that we have highly efficient advertising. People are advertising at the point where customers have their credit cards out and are ready to make a purchase. It's also very measurable.”

🔊 Google Q2 2022 advertising sales grew 12% YoY to $56.3B. Mentioned it will continue to invest in shopping capabilities on YouTube.

🔊 Meta Q2 2022 advertising sales declined 1% YoY to $28.3B. Ad impressions grew 15% while average price per ad declined 14%. Reels is now at a $1B annual revenue run rate. Currently has 2.0B DAU and 2.9B MAU across its family of apps. “We seem to have entered an economic downturn that will have a broad impact on the digital advertising business. And it's always hard to predict how deep or how long these cycles will be, but I'd say that the situation seems worse than it did a quarter ago.”

🔊 Shopify is working with Meta and Google on native commerce enablement. This line of business is nascent but growing. “While still a relatively small percentage of overall GMV, GMV through key partner services, including our native checkout integrations on Facebook, Google and Instagram, grew 5x over Q2 last year.”

TikTok is very effective at driving beauty product discovery.

Shopify continues to be excited about Shopify Audiences, its tool that helps merchants find new customers. “It's essentially a 3-step process. A Shopify Plus merchant selects the product they want to sell more of. Machine learning algorithms build an audience of high-intent buyers tailored for that product, and the audience list is directly and securely exported to the merchant's ad network of choice, which we are launching first with Facebook and Instagram.”

🤝 … But acquiring customers is still expensive and inefficient.

Social media advertising CPMs are up 41% YoY. Google and YouTube CPMs are up 108% YoY per Hunch. “We are finding alternatives to performance advertising. Now we are sending catalogs. Now we are advertising on CTV.”

🔊 Roku Q2 2022 revenue grew 18% YoY to $764M and significantly missed expectations. “We believe this pullback mirrors the start of the pandemic in 2020, when marketers prepared for macro uncertainties by quickly reducing ad spend across all platforms.”

🏬 … Which gives retail its place.

Glossier expands into Sephora and breaks with its D2C-only strategy. “With the Sephora expansion, Glossier has a renewed opportunity to reach an abundance of new customers.” Glossier products were also spotted at TJ Maxx.

Parade expands into Urban Outfitters. “At Parade, we’ve been incredibly selective in identifying a retail partner to expand our footprint into the offline underwear category.”

Private label products account for more than three-quarters (77.5%) of Aldi’s sales followed by Trader Joe’s (59.4%), Wegmans (49.4%), and Costco (33.5%).

📣 … And gives creators and influencers an important role to combine content and commerce.

TikTok videos tagged with #primeday2022 and related hashtags were viewed 52M times versus 30M in 2021 and 6M in 2020. “I had no idea what to buy on Prime Day, so I went to TikTok. Most of those videos were users sharing deals they found, and shoppers had to manually go to Amazon and find the same product.”

💵 Galaxy raises $7M from Homebrew and Snap for its fashion resale marketplace that offers vintage, handmade, and upcycled clothing, through live video

🫶 … And is also motivating online merchants to drive traffic to one another.

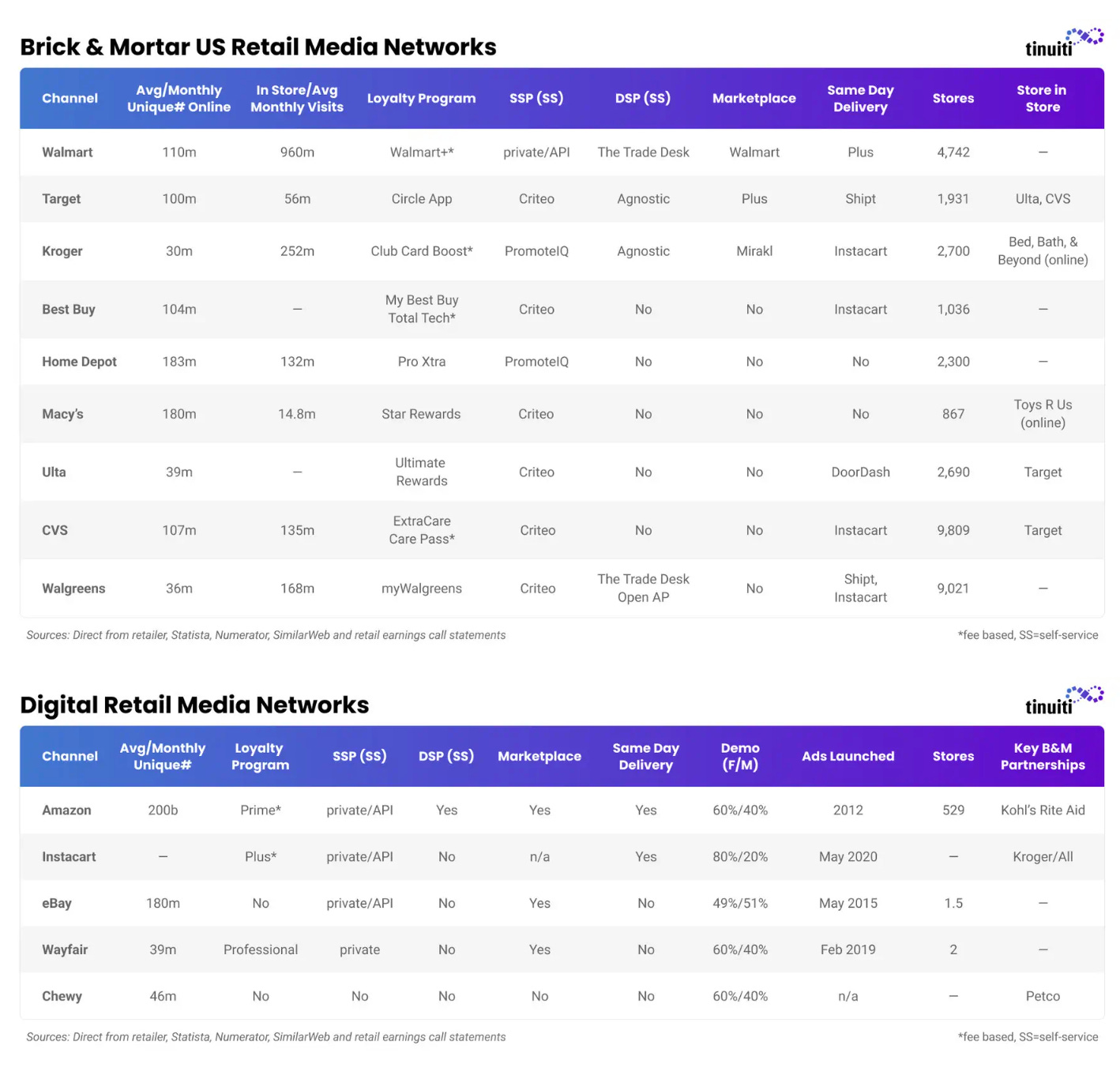

A primer on all the retailers/marketplaces looking to that are investing in their advertising businesses.

🏛️ … And is benefitting large-scale marketplaces who can give brands access to their customer bases.

🔊 Third-party sellers accounted for 57% of all units sold on Amazon in the quarter, the highest percentage ever.

🔊 Etsy Q2 2022 revenue grew 10% YoY to $585M and beat expectations. Added 6M new buyers and attributed the growth to an increase in Etsy marketplace transaction fees, the addition of Depop and Elo7 to the company’s portfolio, and the strength of its Etsy Ads product.

Lululemon lists products on JD.com to access Chinese consumers.

Depop now has 30M registered users, up from 13M in 2019. About 90% of its active users are under the age of 26. Some big sellers are shifting their businesses to their own stores and social media accounts however.

☎️ Retaining customers is becoming more important by the day for merchants.

💵 Retina AI raises $8M from Alpha Intelligence Capital for its software that uses AI and data to predict which customers are likely to come back. Customers include Dollar Shave Club, Nestlé and Madison Reed.

🧳 Selling customers more products is top of mind.

17 fashion and beauty brands and retailers have recently introduced a third-party marketplace to their online stores. “These marketplaces let brands sell products from other brands or suppliers through their own website without having to develop, own or ship inventory themselves.”

🔁 Subscriptions and memberships continue to grow in popularity.

🔊 Amazon subscription sales (mainly Prime memberships) grew 10% YoY to $8.7B.

Gillette is succeeding with razor subscriptions. “Customers who go through a customized flow, even if it's simple, tend to have 10-20% higher retention rates compared to customers who are just adding something to their cart.”

💵 Everdrop raises €80 million from Sofina for its subscription cleaning products that allow customers to reuse their plastic household cleaning bottle. “Has six-digit subscription numbers and saw 300% YoY growth in 2021.”

💳 Customers today can choose between many types of payment methods to make transactions with.

🔊 Shop Pay penetration is now 53.1% of GMV in 2Q’22, up from 48.0% in 2Q’21.

Instacart expands EBT SNAP payments to 10 more states which will allow consumers to use food stamps to order grocery delivery from retailers like Albertsons and Sprouts.

🛒 Wholesale is massive and slowly shifting online.

🔊 Watsco, a large HVAC distributor, Q2 2022 revenue grew 15% YoY to $2.1B. Ecommerce revenue grew 25% YoY to $703M and now represents 33% of total revenue. Wholesale is moving online.

🔊 Unilever now drives 14% of sales through ecommerce, up from 6% in 2019.

Faire now drives >$1B annual GMV through its B2B marketplace connecting 500K retailers with 70K brands in 150 countries. “We want to ultimately be the comprehensive operating system for the trillion-dollar B2B retail industry.”

💵 Balance raises $56M from Forerunner for its one-click checkout payment tools to enable B2B commerce.

💵 Cartona raises $12M from Silicon Badia for its B2B marketplace connecting 60K+ retailers with 1.5K+ FMCG suppliers in Egypt. Has processed >1M transactions with an annualized GMV of $120M.

💵 Makershub raises $4.5M from TTV Capital for its software that streamlines purchases between manufacturing buyers and suppliers.

🚢 The logistics of moving products from factories to warehouses to consumers are still so expensive …

🔊 Amazon seller services grew 9% YoY to $27B.

Target is opening 3 sortation centers to cut delivery costs and get online purchases to customers faster.

USPS ends a 30-year-old discounted shipping rate program. Will affect rates on Stamps.com and Pitney Bowes.

Stord, a fulfillment services provider, launches Stord One Commerce, a vendor- and sales channel-agnostic software platform that helps brands connect, orchestrate, and optimize their entire supply chains.

💵 Kitchen United raises $100M from Circle K, Kroger, Restaurant Brands International, and others for its network of 200+ cloud kitchens that enable more efficient food delivery.

💵 Shypyard raises $3M from Gradient Ventures for its supply chain planning software helping merchants forecast inventory needs.

🚚 ... But same-day delivery is expanding the ecommerce market.

Amazon is enabling same-day delivery for Prime members when shopping at Pacsun, GNC, SuperDry, and Diesel. “The option is limited to select items and is free to Prime members as long as they spend at least $25.”

Flow Beverage Corp, a growing water beverage brand, partners with Ohi to enable same- and next-day delivery in New York, Los Angeles, San Francisco and Chicago.

💵 Nash raises $20M from A16Z for its delivery orchestration platform that plus into third-party delivery providers like DoorDash, Uber, and a vast network of 200+ additional partners to facilitate delivery for merchants across food, flowers, pharma, and more.

☮️ Aligning commerce with social good (sustainability, social justice, equality) is becoming necessary.

Sperry is investing in two new audiences for its brand: 1) ethical shoppers looking for sustainable, purpose-driven brands and 2) fashion-conscious streetwear heads. “We are on a journey to make Sperry a purpose-driven brand.”

Walmart launches a refurbished product program called “Walmart Restored” that will sell used products that the company touts as “good as new.”

Eddie Bauer is adding a resale option to its gear rental program. The resale program, which will accept Eddie Bauer apparel, footwear, accessories and gear, is being powered by ThredUp.

Hermès has no interest to enable resale of its goods and still does not sell its products online. “It would be to the detriment of our regular client who comes to the store.”

Saks OFF 5TH partners with Rent the Runway to provide Saks customers access to pre-owned designer fashion that they can purchase directly from Rent the Runway.

🔮 Is crypto/metaverse a solution trying to find a problem in commerce? Or the future of commerce?

Tiffany & Co. is launching its virtual (NFT) and physical pendants designed for CryptoPunks owners. Is called the “NFTiff” line. The pendants cost 30 ETH (~$50,000) each, which includes the cost of the NFT, the custom pendant, the chain and shipping/handling.

LEGEND

🔊 = info from public company earnings call

💵 = private fundraise announcement

🤗 = M&A announcement

🔔 = IPO announcement

🤝